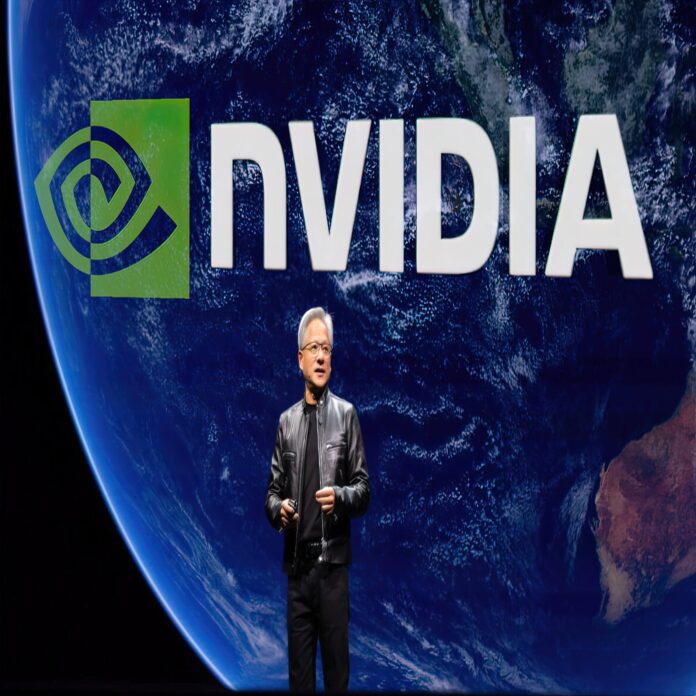

Nvidia, the artificial intelligence powerhouse, reported quarterly sales of $30 billion, surpassing expectations but showing signs of slowing growth compared to previous quarters. The California-based AI chipmaker, led by CEO Jensen Huang, saw its stock price drop by about 4% in after-hours trading, despite doubling sales and profits from the same period last year.

Nvidia has been hailed as the “world’s most important stock” by Wall Street, with its powerful AI chips and software forming the backbone of generative AI technologies used by Microsoft, Google, Meta, Tesla, and Amazon. These tech giants rely heavily on Nvidia to power their AI models, driving demand for the company’s products.

However, investors appear to be nervous that Nvidia’s extraordinary growth, driven by the AI boom, may be slowing. While Nvidia’s share price has surged by 160% year-to-date and has contributed significantly to the S&P 500’s gains, concerns are rising over whether the AI frenzy can sustain its momentum.

Earlier this year, Nvidia briefly became the world’s most valuable company by market capitalization. But despite its strong performance, the company’s forecast of $32.5 billion in revenue for the next quarter left some investors disappointed, as it suggests that the triple-digit growth era may be tapering off.

Nvidia’s financial results have become a focal point on Wall Street, as the company consistently exceeds expectations. “Nvidia once again delivered spectacular results, but investors are starting to wonder if the company can maintain its breakneck growth pace amid economic uncertainties and concerns over an AI bubble,” said Jacob Bourne, a technology analyst at Emarketer.

The market’s reaction also hinges on Nvidia’s new Blackwell line of AI chips, the successor to the best-selling Hopper series. Any delays in launching this next-generation technology could impact investor sentiment further.

For now, Nvidia remains a dominant force in the AI sector, but investors are closely watching to see if its growth trajectory continues or if the stock’s meteoric rise is starting to stabilize.